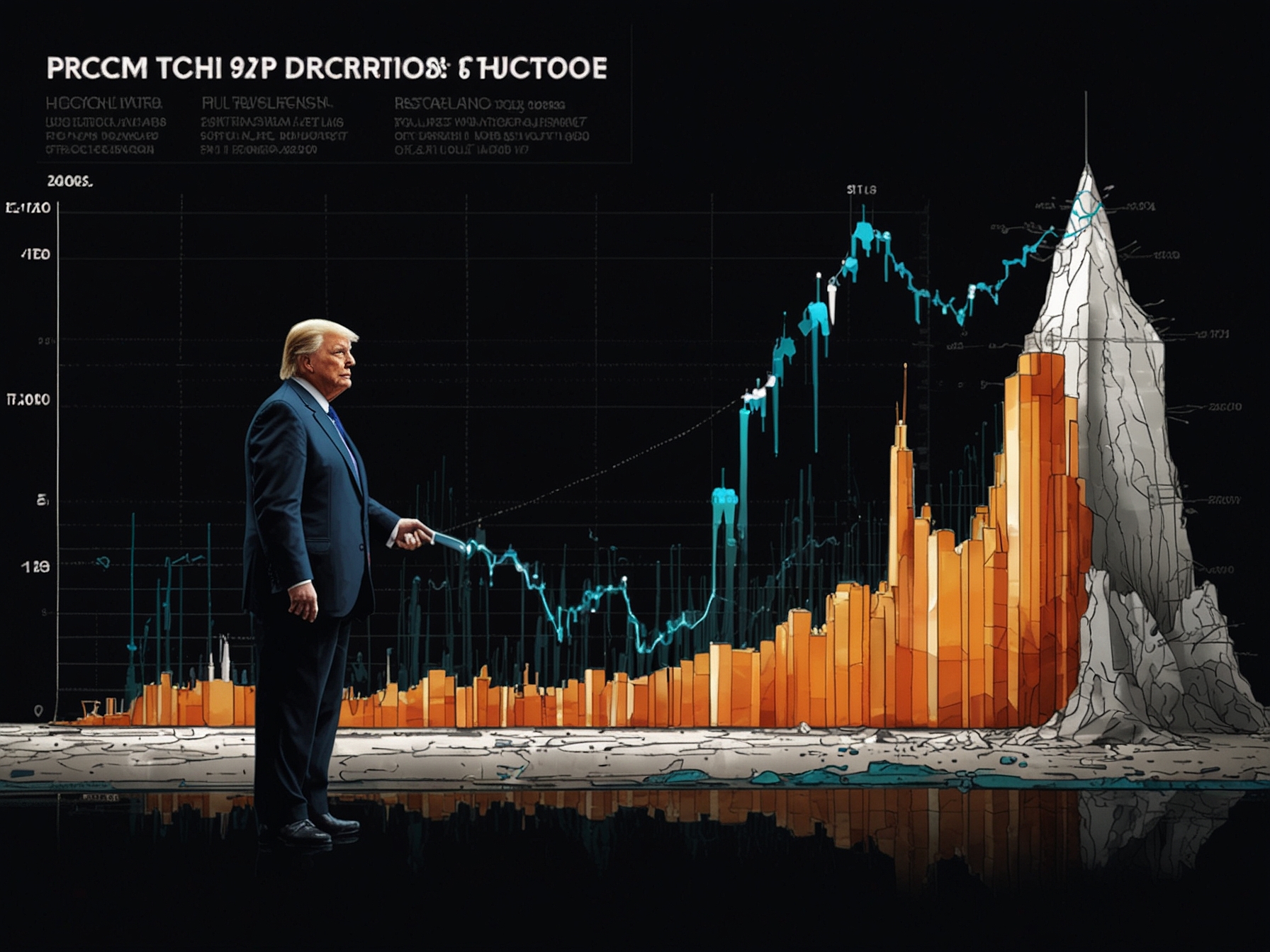

Bitcoin’s remarkable rise has captivated the public. As it surged past $100,000 for the first time, many wondered: what does this mean for the future of cryptocurrency? The announcement of Trump’s SEC chair pick has ignited new hopes.

On Wednesday, Bitcoin crossed a significant milestone. This surge coincided with President-elect Donald Trump nominating Paul Atkins as the next SEC chair. This is crucial news for crypto enthusiasts. Atkins has been a vocal advocate for cryptocurrency. His vision contrasts sharply with that of the current SEC commissioner, Gary Gensler.

Gensler’s tenure has been marked by rigorous scrutiny. Under his leadership, the crypto industry faced challenges. Regulations tightened, stifling innovation. In stark contrast, Atkins promises to adopt a more lenient approach. This shift could rejuvenate the cryptocurrency landscape in the U.S.

The timing of this surge is no coincidence. Bitcoin had already begun its upward trajectory after Trump’s election victory was projected on November 6. A stunning one-day spike of $6,000 sent Bitcoin soaring. This momentum continued as speculations grew and enthusiasm spread.

Having climbed an astounding 130% in 2023, Bitcoin has outperformed traditional stocks. The S&P 500, by comparison, rose just 28%. This stark contrast raises important questions. Why the growing interest in Bitcoin? How does its performance reflect shifting attitudes toward finance?

Trump’s relationship with crypto has evolved significantly. Once a skeptic, he described Bitcoin as ‘not money.’ Now, he aims to capture a crucial voting demographic. Younger, tech-savvy voters are investing in cryptocurrencies in greater numbers. Understanding this shift provides insight into the changing landscape of American politics and finance.

Flash forward to July, where Trump headlined a massive crypto convention. The atmosphere buzzed with excitement. Here, he announced plans for a ‘national bitcoin stockpile.’ This was a groundbreaking pledge, signaling commitment to the crypto community. He emphasized, ‘I want it to be mined, minted, and made in the USA.’

Moreover, Trump’s personal venture into cryptocurrency further underscores his shift. Launching World Liberty Financial marked a significant step. This business move opens up new possibilities. Could it symbolize a deeper interest in the cryptocurrency realm among mainstream politicians?

Notably, Trump’s use of Bitcoin for a burger purchase at a popular venue in Manhattan highlighted his newfound approach. Those words, ‘History in the making,’ resonated with many. This act showcased crypto’s potential for everyday transactions. It’s becoming part of the cultural zeitgeist.

With these developments, the future of Bitcoin seems brighter than ever. Yet, as with all investments, volatility looms. Will this energy translate into sustainable growth? As more people embrace cryptocurrencies, the stakes will only rise.

So, what’s next? The landscape depends on regulatory practices. The choices made under Trump’s administration could either propel Bitcoin upward or introduce unforeseen challenges. For now, Bitcoin’s ascent feels like just the beginning.