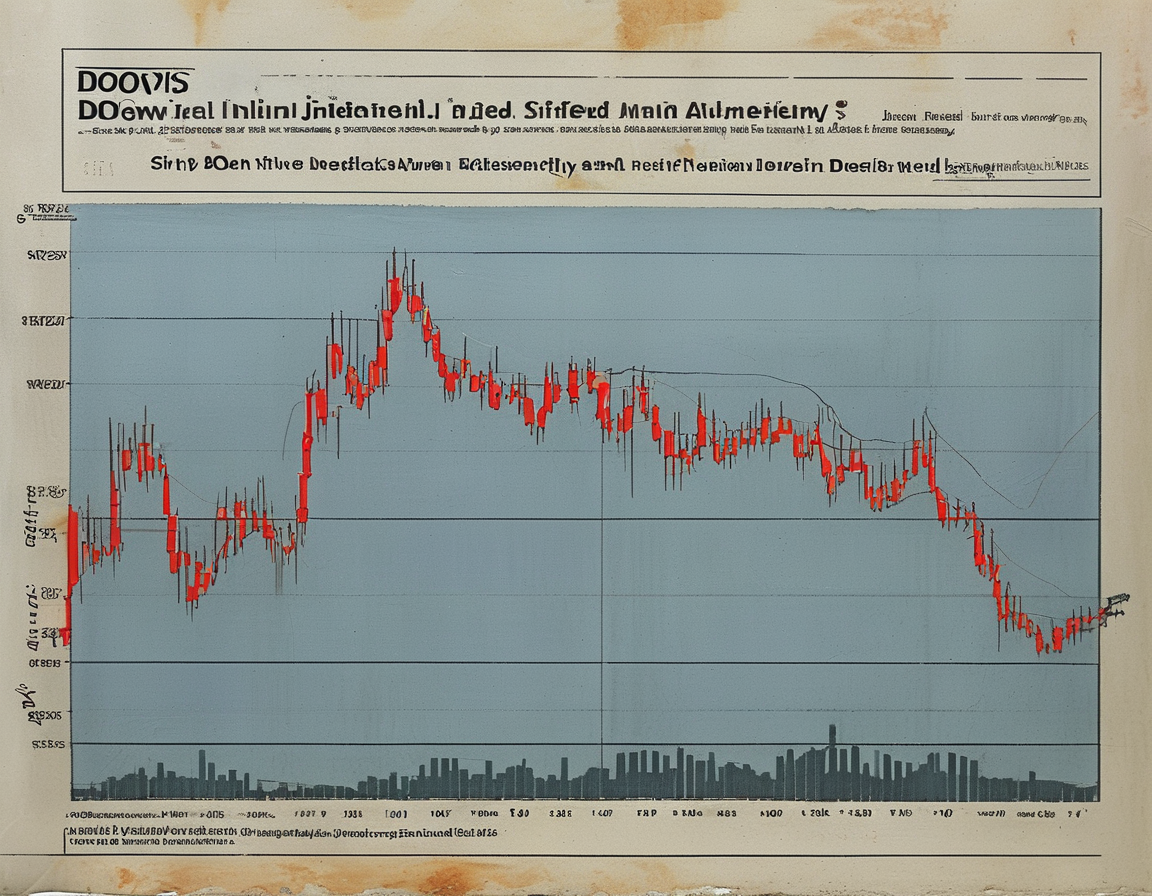

The Dow’s Historic Streak

The Dow Jones Industrial Average is on a tear—just not the kind you’d want. Recently, it registered its ninth consecutive day of losses. That’s the longest losing streak since 1978. It’s almost surreal to think about. One might wonder, how does this impact our everyday lives?

On a day like today, a 0.6% drop might not seem catastrophic. But, in a broader sense, it raises questions. Will our investments be okay? Should we alter our spending habits? This is particularly critical when we consider looming decisions from the Federal Reserve.

Every day, anecdotes abound of families watching their savings shrink. Last week, a friend confided that her retirement plans had taken a hit. It’s tough to process these fluctuations. People want stability, after all.

Impact of the Federal Reserve

Speaking of stability, the looming Federal Reserve meeting adds another layer. Policymakers are about to weigh in, likely opting for a 0.25% rate cut. The anticipation is palpable. Yet, this situation also has pundits talking about a shift in the economic landscape.

If the Fed moves ahead with the cut, what will it mean for inflation? That question sits at the back of many minds. While some analysts suggest this might be the last cut for a while, others are skeptical.

Inflation can be a silent thief, slowly eating away at your savings. It’s fascinating to consider how these decisions ripple out. What happens to everyday consumers as the Fed pivots? It deserves our attention.

Wall Street Uncertainty

As stocks fell today, the other major indexes followed suit. The S&P 500 dropped about 0.4%, while the tech-heavy Nasdaq saw a dip of around 0.3%. This seems oddly timed after its impressive record high just yesterday. Was it a feat of overconfidence?

Such sudden shifts have caused raised eyebrows among investors. It’s like a roller coaster—you never quite know what’s next. Watching previously sturdy stocks falter can spark anxiety. It raises the stakes and fuels speculation.

With whispers of sustained inflation, navigating this landscape is daunting. Are our financial strategies solid enough to endure these turbulent times? How can we prepare ourselves for whatever lies ahead?

Looking Ahead to 2024

So, what lies ahead in January? Expectations are anything but clear. Today’s news leaves many wondering about their future options. It’s a precarious balance: optimism versus caution.

Many individuals find themselves wrestling with questions. How do you save effectively in a turbulent stock environment? What investments are still considered ‘safe’? These reflections go beyond numbers. They touch our lives directly.

We approach this uncertainty together. Navigating our financial futures may not be foolproof, but awareness is the first step toward preparedness. Engaging with the unknown is crucial as we await the Fed’s decision.