Understanding the Current Market Volatility

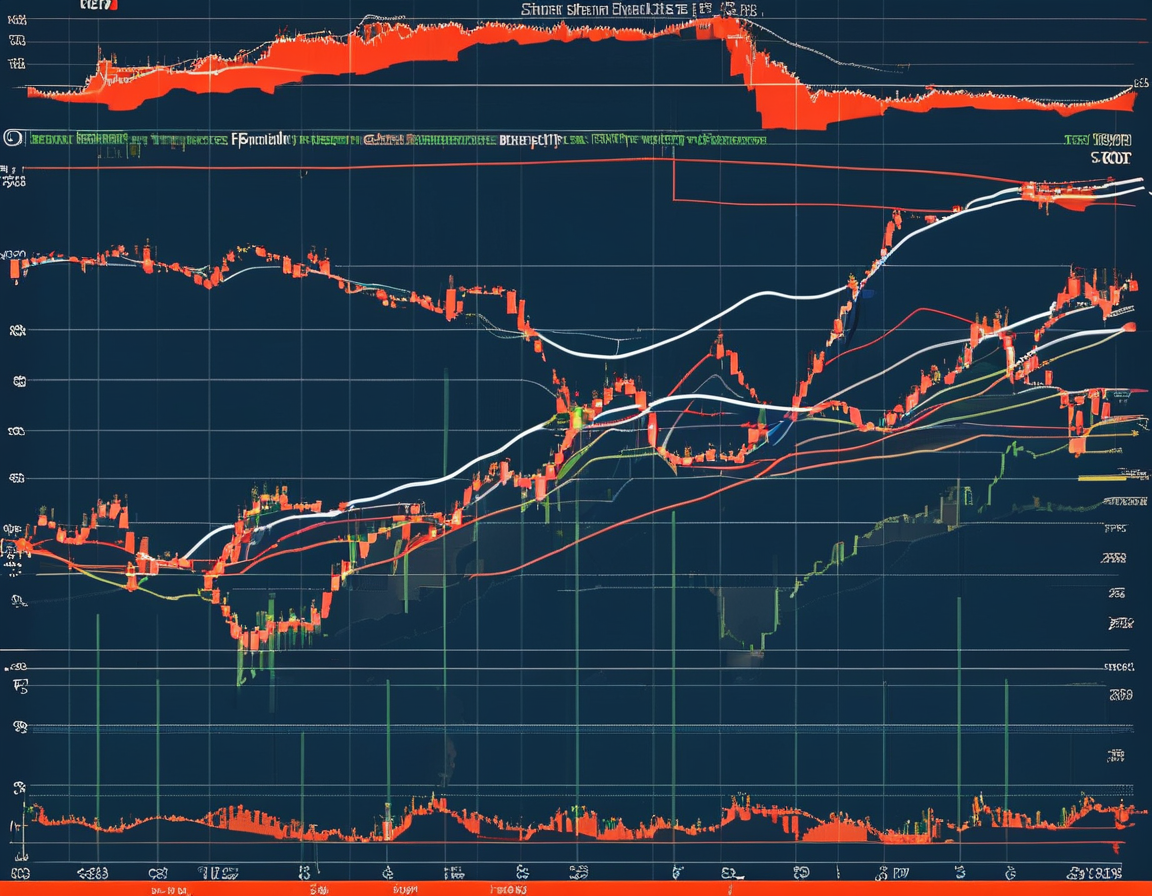

Market fluctuations can feel like riding a rollercoaster. One moment, you’re soaring high; the next, you’re plunging into uncertainty. Such is the case with the Vanguard S&P 500 ETF (VOO), which recently dipped by 1.51%. As of the latest report, VOO sits at $547.06, down $8.39. It’s easy to panic during these drops. However, it’s vital to remember that every dip can offer insight into larger economic dynamics.

Amid the chaos, many wonder: what does this mean for the average investor? The larger trend shows the S&P 500 has also been shaky. Influencing factors range from fluctuating corporate earnings to global geopolitical tensions. In moments like these, it’s essential to understand that market shifts are normal. Investors often face the test of maintaining perspective.

The Role of Economic Factors

Considering the broader economic picture is crucial. Interest rates, inflation, and consumer confidence all intertwine, impacting stock performance. For instance, spikes in inflation can lead central banks to increase interest rates. Such moves can rattle investors. Yet historical data often showcases that markets bounce back. Those investing in VOO should focus not only on daily fluctuations but also on how these economic indicators affect overall growth.

Imagine someone in a storm. They can’t control the weather but can seek shelter. Similarly, investors can’t fundamentally change the market’s trajectory. Yet, they can shield their investments through knowledge and strategy. Recognizing patterns in economic trends helps build that shelter.

Long-term Investment Perspectives

Now, let’s talk about the silver lining. Market declines can be stepping stones for long-term gains. Many financial experts advocate for a buy-and-hold strategy. Think of it like planting a tree; it takes time to grow and bear fruit. VOO, with its robust historical performance over the past year, stands as a testament. With a 52-week price range from $428.65 to $559.96, its current position shows resilience.

What drives this optimism? Well, analysts suggest that downturns in the market can lead to attractive entry points for potential buyers. If you view VOO as a long-term investment, today’s issues may barely matter in years to come. Staying the course can yield rewards.

Seeking Professional Guidance

Navigating through market dips can feel lonely, daunting even. That’s where consulting a financial advisor can make a difference. Advisors can offer tailored strategies that align with your financial goals. In moments of erosion like today’s market dip, having a guide can shift uncertainty into opportunity. It’s okay to feel uneasy, but seeking outside help could be vital.

As we race toward the end of 2024, investors should remain vigilant. How will VOO navigate political currents and economic shifts in these months? The journey through investing is often bumpy. But as you learn from these ups and downs, remember—each dip may just be the chance you were waiting for.