### Telecom Price Hikes and User Backlash

In July 2024, three major telecom companies—Jio, Airtel, and Vodafone-Idea—hiked their tariff plans. This move sparked an uproar. Customers took to social media, expressing outrage. The call to boycott their plans was loud and viral. Can a simple hike trigger such significant changes in user behavior? It’s clear that price hikes impact more than just the wallet. They touch on trust, value, and loyalty.

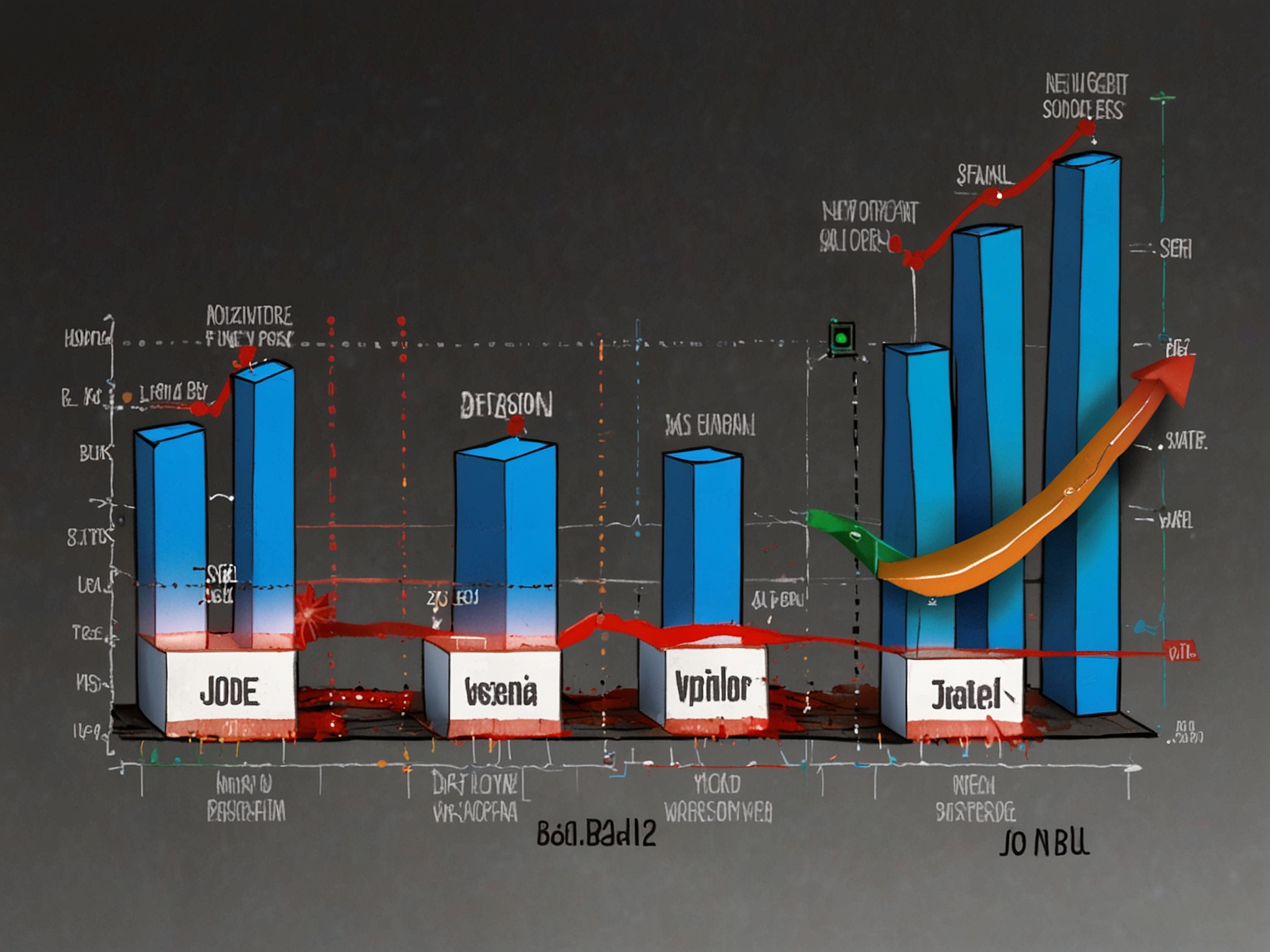

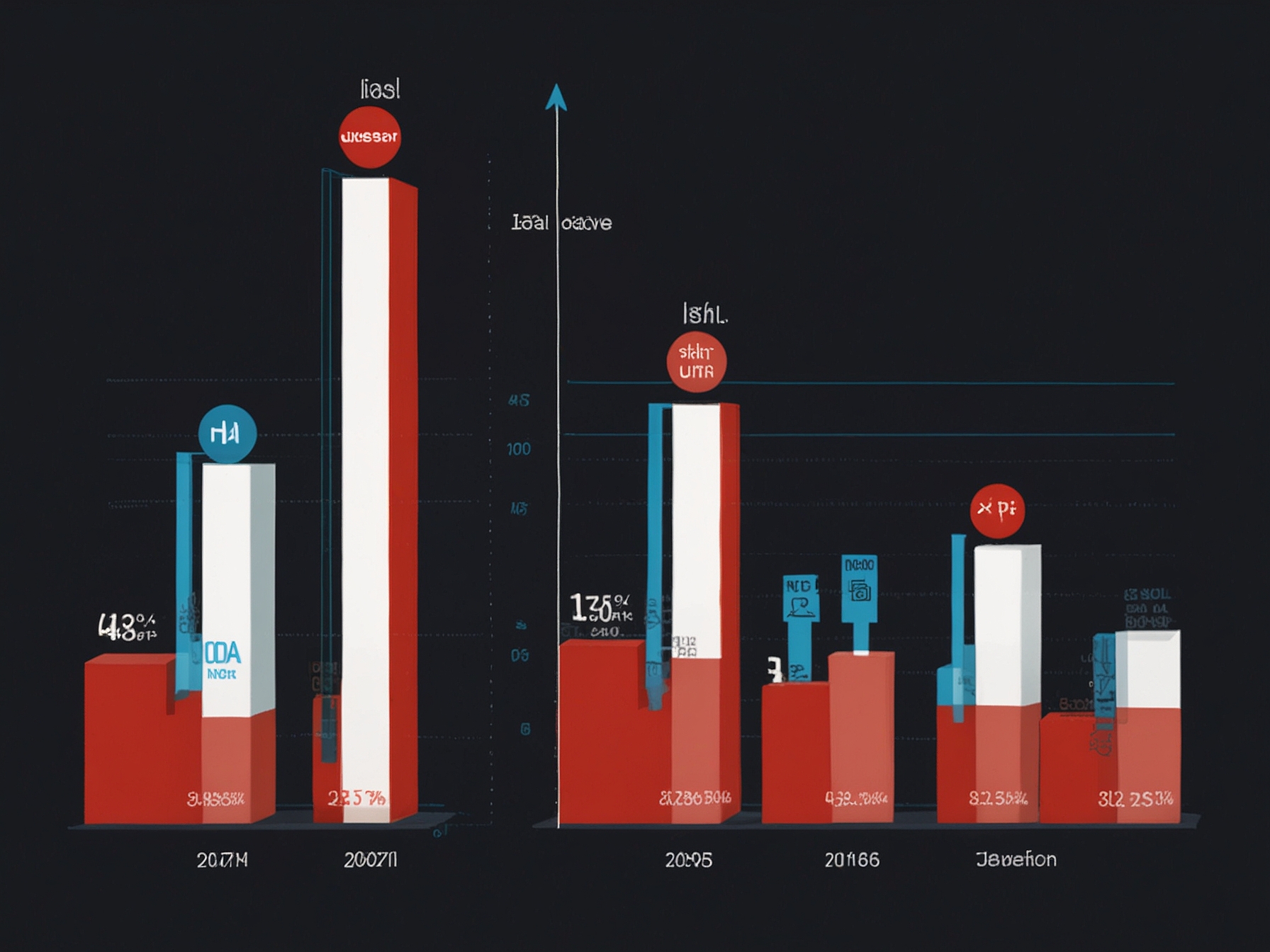

### User Drop-off: A Look at the Numbers

Fast forward to September 2024, and the data tells a stark story. Jio’s user base dropped from 471.74 million to 463.78 million. Airtel fell from 384.91 million to 383.48 million. Vodafone-Idea saw a similar fate. Numbers speak. They reflect discontent and signal shifting loyalties in the telecom landscape.

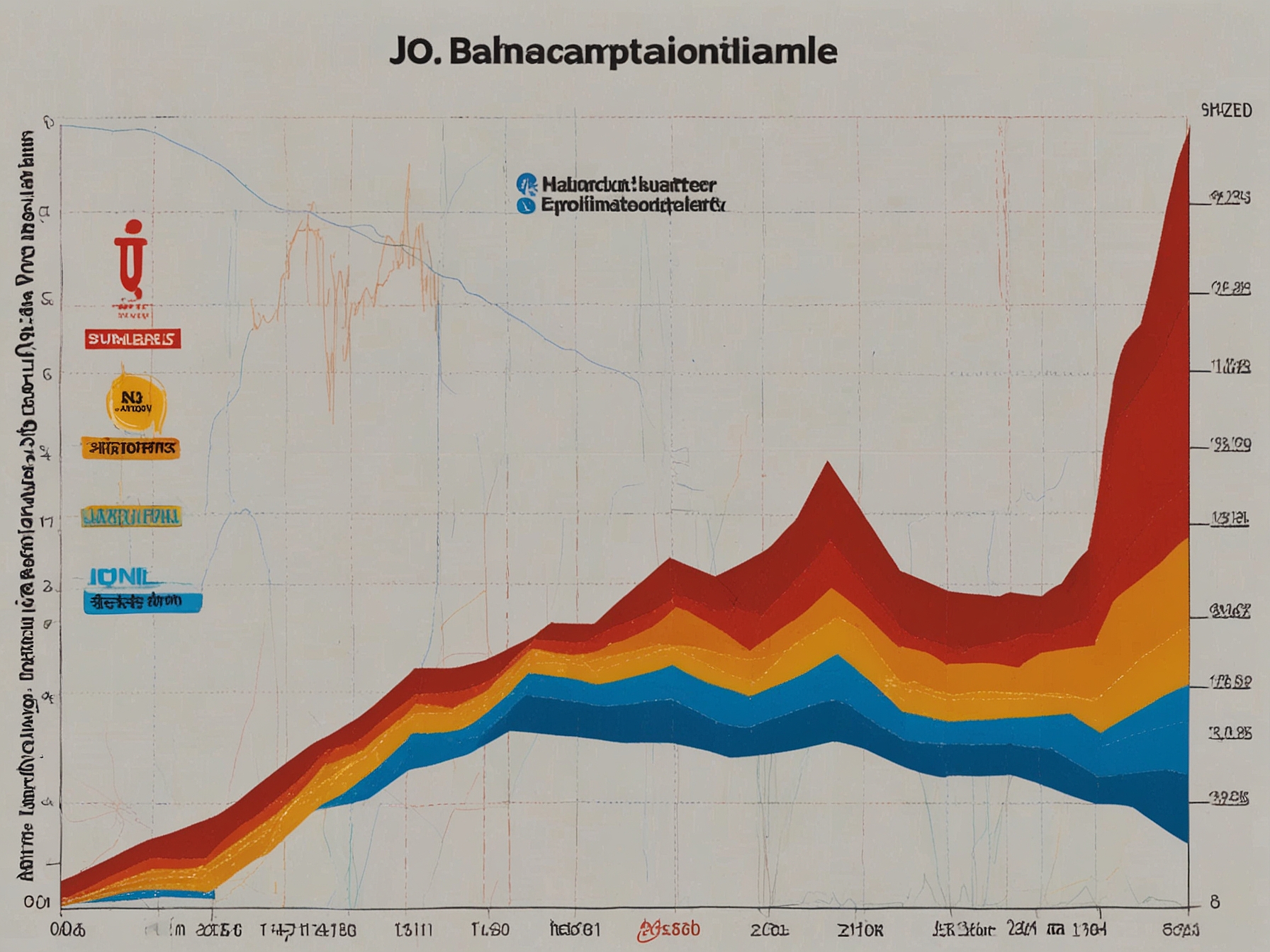

### BSNL: The Unexpected Winner

In the midst of this turmoil, BSNL emerged as a surprising contender. The government-backed telecom service gained traction, swelling its user base from 91.04 million to 91.89 million. Why are users turning to a company once deemed less innovative? Perhaps it offers a sense of stability that resonates with consumers frustrated by private players.

### Granular Insights: Who Are the Active Users?

The changes also affected active users. Airtel’s active user count dipped by 1.31 million. Vodafone-Idea saw a 3.11 million drop, proving that price sensitivity is real. Even Jio’s active users decreased by 1.73 million. This isn’t just about numbers; it’s a reflection of emotional ties that have frayed. What leads one to switch? Satisfaction, trust, and pricing all come into play.

### The Price Factor: Understanding Tariff Increases

The hikes ranged from 11% to 25%, making even the staunchest loyalists rethink their options. Suddenly, affordability is front and center. The cost of living is high, and each rupee counts. In a digital age, are we really willing to pay more for services that feel less personal? This question looms large.

### Why Choose BSNL? Trust and Stability

BSNL seems to offer more than just competitive pricing. For many, it represents a return to basics. In a world where flash discounts and aggressive marketing reign, consumers value the dependability BSNL provides. It’s an emotional connection, grounded in tradition and reliability.

### The Bigger Picture: A Shift in Consumer Behavior

These changing tides suggest a broader shift in consumer behavior in India’s telecom industry. Trust is a currency more valuable than ever. The public discourse surrounding these changes hints at rising expectations from telecom providers. Users are willing to pay for peace of mind, even if it means a minority government-backed option.

### Conclusion: The Future of Telecom in India

As charts depict declining user bases for Jio, Airtel, and Vodafone-Idea, the question arises: what comes next? Will these companies take notice and adjust not just their pricing but their overall approach to customer relations? It’s a wake-up call for all telecom players. The era of customer indifference is gradually fading away.