The Dow’s Dramatic Dive

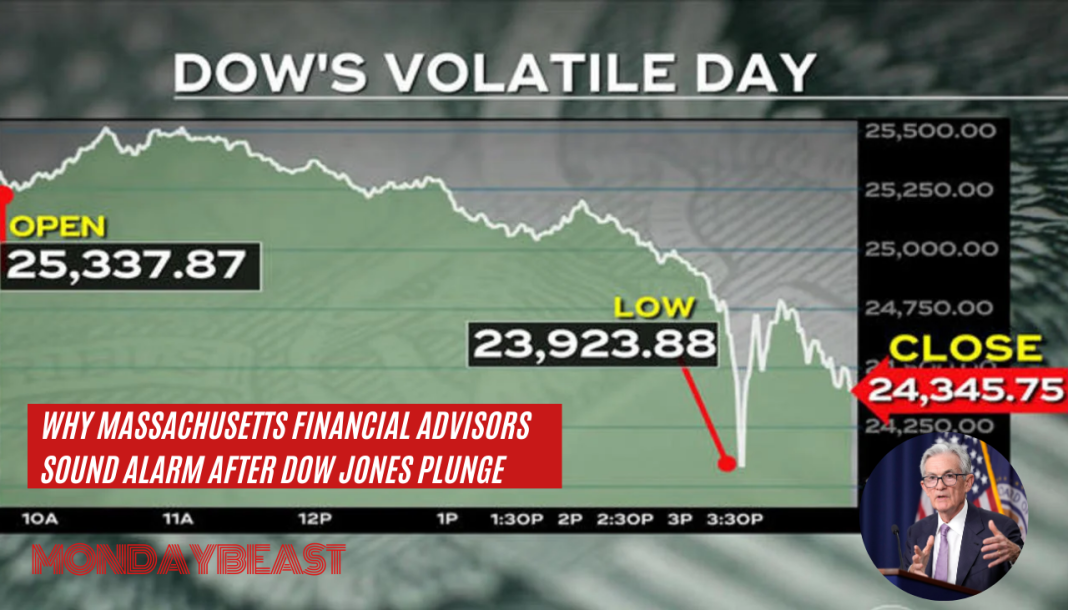

On Wednesday, the Dow Jones experienced a significant drop, closing down over 1,100 points. This marked the second-worst decline of the year. Financial markets feel the impact of reduced hopes for future rate cuts in 2025.

For those tracking the ups and downs of the market, watching the Dow tumble can feel like a punch to the gut. This downturn follows a disheartening announcement from the Federal Reserve. The Fed now forecasts only two rate cuts next year, a sharp change from earlier expectations of four.

When Mike Armstrong from the Armstrong Advisory Group spoke, it was clear there was concern. He noted how markets reacted negatively to optimistic projections about economic growth and a robust labor market. It’s an ironic twist. Good news for the economy doesn’t always translate to good news for stock prices.

Interest Rates: The Bigger Picture

In the wake of this volatility, many are left wondering: what does all this mean for mortgages? With the Fed cutting rates for the third time this year, it might seem like hope is on the horizon. However, as Armstrong points out, if you’re waiting for a 6% mortgage rate, you might be disappointed.

Many potential buyers feel stuck. Thus, the Federal Reserve’s expectations influence not only Wall Street but also Main Street. If bank rates don’t drop significantly next year, what does that mean for first-time homebuyers wanting a break? The path seems unclear.

The Fed emphasizes the importance of cautiously navigating current economic conditions. Chair Jerome Powell’s comments about moving slowly may resonate with many. In times of uncertainty, waiting it out might actually serve us better.

Inflation’s Grip

Yet inflation persists stubbornly, refusing to let up. While the economy exhibits signs of strength, many are left grappling with rising prices at the grocery store. Everyday essentials cost more. Is it possible to expect economic growth while prices soar?

This juxtaposition creates tension. Inflation and growth at odds. It’s not easy to think of balancing trust in market stability while feeling the squeeze day to day. After all, can we truly relish economic gains when our purchasing power feels threatened?

These concerns don’t only stack upon the heads of financial advisors but also weigh heavily on families and individuals trying to make ends meet. Solutions seem elusive, yet the need for strategic financial planning has never been higher.

Future Uncertainty Ahead

As we further explore what lies ahead, it dives deeper than monthly rate changes and market moves. The uncertainty surrounding the new presidential administration adds another layer of unpredictability in the mix. How will that factor into the economy’s future?

The collaboration between governmental policy and financial markets feels prominent now. The time may come when people need to readjust financial strategies to adapt to new realities. But how to navigate such changes? Investment advice becomes all the more crucial.

In tough times, it’s vital to seek out guidance from qualified professionals. Financial advisors, ever-watchful, serve as guides through stormy waters. The role of well-informed support becomes critical in establishing a path forward. It’s all about finding a balance in an uncertain world, moving toward greater stability.