Nifty’s Near Miss at 23,800

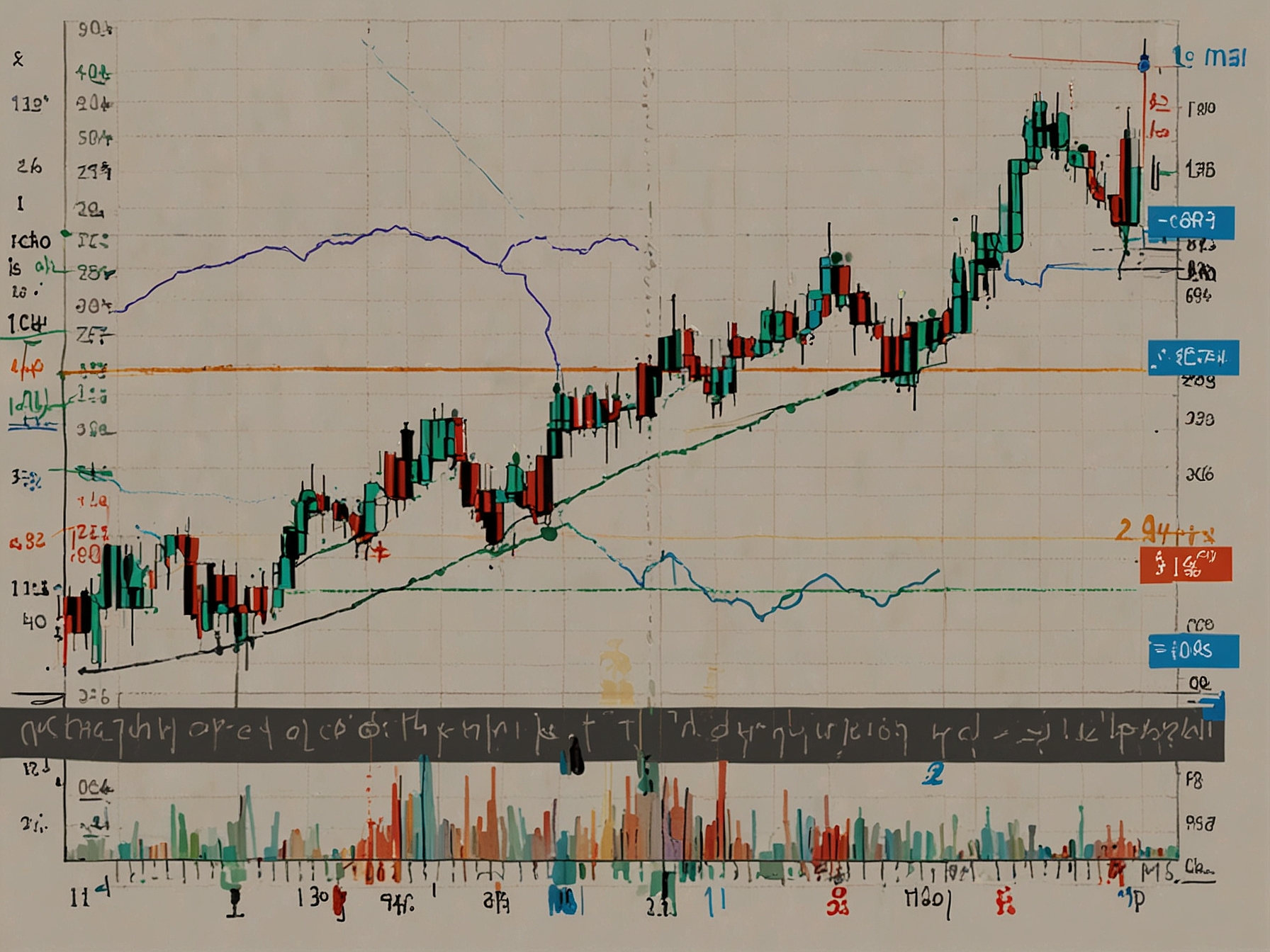

On November 19, traders held their breath. The Nifty 50 approached a pivotal level of 23,800. This number isn’t just a figure; it represents the 50 percent Fibonacci retracement from the June low to the record high in September.

It nestled tantalizingly close, whispering promises of an upward rally. Could it break through? Experts suggest, if it does, momentum could propel the index towards the elusive 24,000 to 24,500 range.

But here’s the catch: failing to sustain above the 200 DEMA, sitting at 23,541, could shift the tide back towards 23,200.

How Nokia’s Game-Changing Deal with Airtel Transforms India’s 5G Future

Bank Nifty: Eyeing New Heights

The Bank Nifty, too, was in the limelight on the same day. Rising 263 points to 50,627, it showed robust signs of life. A significant threshold loomed—the 10 DEMA around 51,000.

If it manages to scale that, there’s a strong chance it could hit the 51,500 to 52,000 zone. Yet, if it dips below 50,300, the scenario shifts. Falling past that Fibonacci retracement could drag it down toward the 200 DEMA of 49,900.

The stakes are high, and traders wonder which way the market will sway.

Market Sentiment and Trading Strategy

The market breadth on November 19 painted a positive picture. With 1,628 shares advancing against 846 declining, optimism seemed palpable. But in trading, sentiment can change in a heartbeat.

Many traders grapple with decisions at times like these. Should they hold tight or cut losses? The tension is almost palpable. For novice traders, it’s crucial to have a plan.

Developing a strategy based on these levels might be the key to navigating the uncertainties ahead. In this volatile environment, will Nifty surge, or will it slip back? Only time will tell.